Montreal is known for its cultural vibrancy, stunning architecture, and, of course, its unpredictable weather. From harsh winter snowstorms to sudden downpours in the summer, the city’s weather conditions can pose challenges to even the most experienced drivers. With such fluctuating conditions, it’s no surprise that car insurance premiums in Montreal are often influenced by the local weather.

For drivers in the city, understanding how weather affects their car insurance can help them make more informed decisions when choosing coverage. If you’re looking for competitive rates, visit car insurance Montreal to explore options tailored to the city’s unique driving environment.

The Impact of Montreal’s Winter on Insurance Premiums

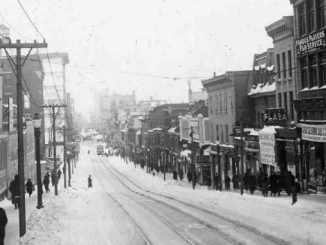

One of the most significant weather-related factors that affect car insurance premiums in Montreal is the harsh winter. From late November through March, Montrealers deal with heavy snowfalls, icy roads, and extreme cold. These conditions can dramatically increase the risk of accidents, which leads to a higher number of insurance claims. Insurers take this increased risk into account when determining premium costs.

Winter driving requires extra caution, as poor visibility, slippery roads, and black ice contribute to fender benders and more severe accidents. In fact, studies show that accident rates spike during the winter months, particularly on days with freezing rain or snow. The high probability of collisions during these months means that insurance companies often charge higher premiums to cover the additional risks associated with winter driving.

The Role of Seasonal Changes in Insurance Rates

Montreal’s weather can change rapidly throughout the year, with summer bringing rainstorms, hail, and extreme heat. While summer is often seen as a less dangerous time for driving compared to winter, it still has its own set of risks. For instance, sudden rainstorms can cause flooding on roads, making it difficult for drivers to control their vehicles.

In some cases, these weather patterns can lead to more claims being filed for weather-related damage, such as hail-damaged cars or vehicles that have been flooded. Insurance companies adjust premiums based on the likelihood of these claims, which means that in areas where weather damage is more common, premiums tend to be higher.

How Insurers View Weather-Related Claims

Insurance companies are very aware of the increased risks that come with bad weather. In Montreal, insurers track data on weather-related accidents and adjust their rates accordingly. For example, if a specific neighbourhood experiences a high number of claims during snowstorms, insurance premiums in that area may be higher than in others with fewer claims.

Additionally, insurers often recommend adding optional coverage like comprehensive insurance, which can cover weather-related damages such as hail, falling ice, or flooding. While these add-ons increase the overall cost of your insurance, they provide valuable protection in a city like Montreal, where weather conditions are unpredictable.

Reducing Your Premiums: What You Can Do

While you can’t control the weather, there are steps you can take to reduce your insurance premiums despite Montreal’s climate. Here are a few tips to help lower your costs:

- Winter Tires: Many insurance companies in Quebec offer discounts for drivers who use winter tires, as they significantly improve safety on icy and snowy roads.

- Safe Driving Record: Avoiding accidents, especially in bad weather, will keep your premiums lower over time. Insurance companies reward drivers with clean records.

- Comprehensive Coverage: Adding comprehensive coverage might seem like an extra expense, but in the long run, it can save you money by covering weather-related damages that would otherwise come out of your pocket.

The unpredictable weather in Montreal plays a significant role in determining car insurance premiums. From icy winter roads to sudden summer storms, the risks associated with Montreal’s climate are factored into the cost of insurance policies. Understanding how these factors impact your premiums can help you make better decisions about your coverage and potentially lower your costs by taking precautions like using winter tires and maintaining a clean driving record.

By being aware of these weather-related risks and considering comprehensive coverage, you can protect your vehicle and enjoy peace of mind no matter what the weather brings. For tailored insurance options that consider these factors, be sure to explore car insurance Montreal.